Will the 100B OpenAI deal ignite the next Nvidia stock supercycle?

%20(1).webp)

Nvidia’s $100 billion partnership with OpenAI lifted its stock to a record $183.68 this week. Many say the deal positions Nvidia at the centre of the artificial intelligence revolution, but it also raises questions of sustainability. On one hand, the agreement secures Nvidia’s role as the supplier of compute power that OpenAI needs to pursue superintelligence. On the other hand, stretched valuations, regulatory risks, and long delivery timelines may limit the upside.

Key takeaways

- NVIDIA's stock closed at a record $183.68 after announcing a $100B partnership with OpenAI.

- The deal is structured as two transactions: OpenAI will pay Nvidia in cash for chips, while Nvidia will invest back into OpenAI for non-controlling shares.

- The first $10 billion tranche will be triggered once OpenAI signs a definitive chip purchase agreement.

- OpenAI plans to deploy at least 10 gigawatts of Nvidia systems by 2026, starting with 1GW on the Vera Rubin platform.

- Nvidia has already been part of a $6.6B investment in OpenAI (Oct 2024) and pledged $5B to Intel days before this announcement.

- Microsoft retains rights to 49% of OpenAI’s profits from its earlier $13B investment.

- The Magnificent 7 now make up 35% of the S&P 500, while the top 10 stocks account for 41% of the total market cap.

- The DOJ and FTC are preparing potential antitrust probes into Microsoft, OpenAI, and Nvidia.

Nvidia OpenAI partnership

The partnership is among the largest in AI’s history. According to people close to the matter, Nvidia will begin delivering data centre chips to OpenAI in late 2026 and also take a non-controlling equity stake in the company.

The two companies have signed a letter of intent for at least 10GW of Nvidia hardware to support OpenAI’s infrastructure. The initial $10B phase is dependent on OpenAI finalising chip purchases. The project’s scale is enormous - it rivals some national power grids - and underscores how compute capacity has become the most valuable currency in AI.

OpenAI is still restructuring into a for-profit company, a process complicated by Microsoft’s existing profit-sharing arrangement and ongoing legal challenges. Nvidia’s entry adds further weight to the governance and strategic direction of one of the world’s most valuable AI companies.

Why the rally could continue

After Nvidia’s $100 billion partnership with OpenAI lifted its stock to a record high this week, the strongest case for Nvidia’s rally continuing lies in its unrivalled position in AI infrastructure.

Sam Altman has emphasised that “everything starts with compute,” and OpenAI’s ambition to move toward superintelligence will require hardware on a scale never seen before. Nvidia is currently the only company with the proven technology and production capacity to deliver this level of compute.

AI infrastructure buildout

Beyond the OpenAI deal, Nvidia has embedded itself across the wider AI ecosystem. It is a central partner in the $500 billion Stargate data centre project alongside Microsoft, Oracle, and SoftBank, and days before the OpenAI announcement, it pledged $5 billion to support Intel. These moves highlight a deliberate strategy to ensure Nvidia’s hardware is present in every significant AI buildout.

Investor momentum also strengthens the bullish case. Following the announcement, shares of AMD rose 3%, TSMC climbed 4%, and Oracle gained nearly 5%, reflecting the market’s conviction that the deal validates Nvidia’s dominance. With OpenAI valued at $500 billion, Nvidia’s commitment signals to investors that capital will continue to flow into AI despite earlier concerns that spending might slow.

Why a pullback could loom

Despite the optimism, there are compelling reasons why the rally may not be sustainable. According to analysts, the first is timing. Nvidia’s deliveries under the OpenAI deal are not scheduled until late 2026, meaning much of the financial impact lies years ahead. Markets, however, are already pricing in that future growth, leaving little margin for error.

Market concentration is another risk. The top 10 US stocks now account for 41% of the S&P 500’s market cap, a sharp increase from 20% just two years ago.

Nvidia’s rise has contributed heavily to this imbalance, making the market more vulnerable to sharp corrections if sentiment turns. Regulatory scrutiny also looms large. In June 2024, the DOJ and FTC agreed to coordinate on oversight of the biggest AI players, with Nvidia, Microsoft, and OpenAI clearly in focus. Their combined dominance across hardware, software, and cloud computing could trigger antitrust action, particularly if political winds shift.

Valuation concerns are equally pressing. Nvidia’s $100 billion commitment is larger than the GDP of many countries. With its market cap already at historic highs, the company is priced for near-perfect execution. Any delay in adoption, weaker-than-expected profitability, or competitive pressures could weigh heavily on its stock.

Finally, geopolitics remains an unpredictable factor. As US–China competition in semiconductors intensifies, new export restrictions or tariffs could disrupt Nvidia’s supply chain. Even a company with Nvidia’s scale cannot escape policy risks tied to the global chip war.

Market impact

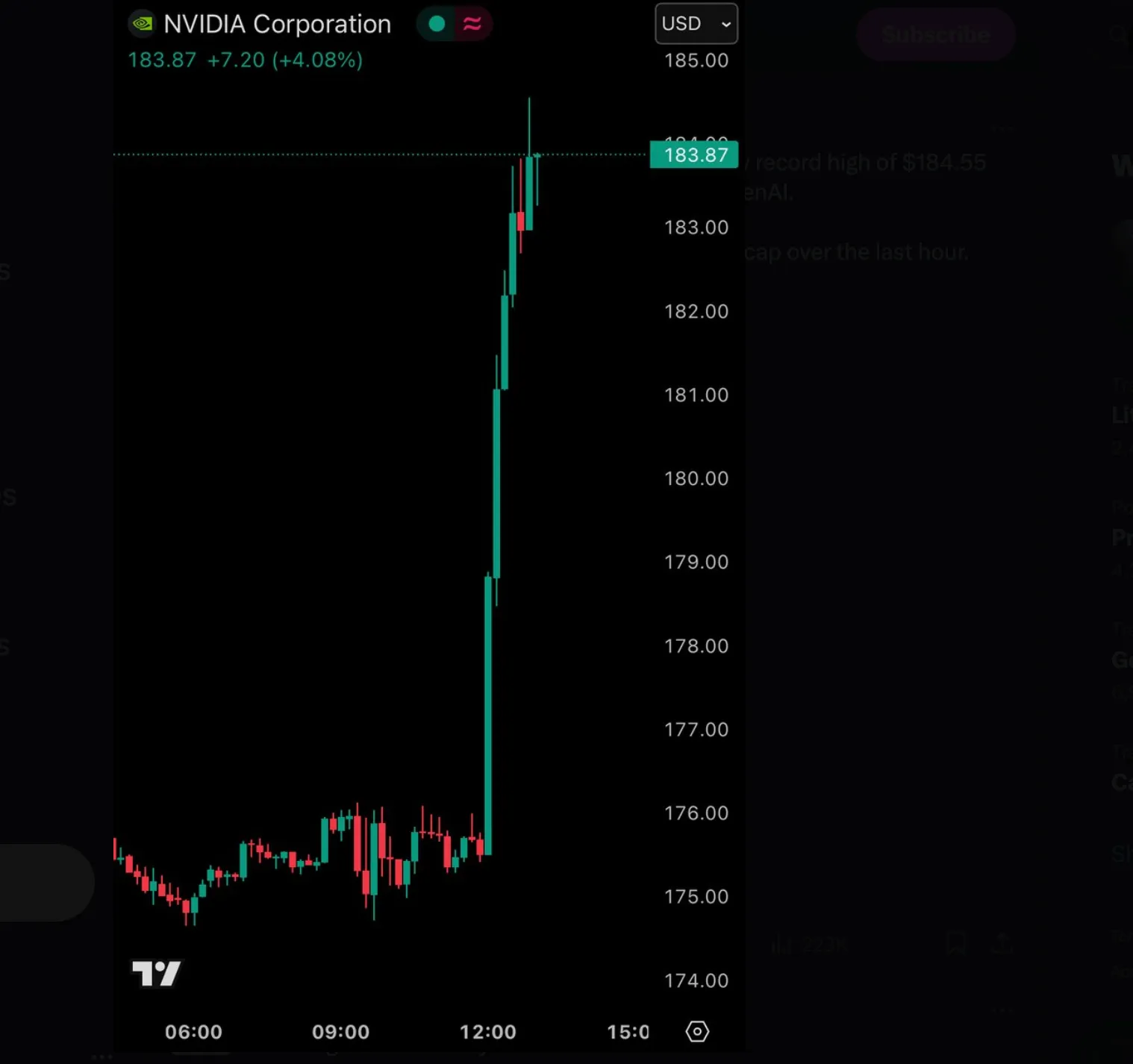

The announcement had an immediate impact on financial markets. Nvidia’s shares jumped 4.4% on the day, Oracle gained nearly 5%, and the Nasdaq Composite added almost 1%. The S&P 500 rose 0.5% to a new record high, driven largely by Nvidia’s surge. With the Magnificent 7 now controlling more than a third of the index, Nvidia’s moves are no longer just stock-specific - they ripple through the entire market.

Nvidia technical analysis

At the time of writing, Nvidia is in price discovery mode, with volume bars painting a narrative of undecided sellers - making the case for a potential further uptick. If higher highs don’t materialise thanks to stronger sell pressure, we could see prices tumble towards the $173.40 support level. A further crash could be held at the $168.00 and $164.35 support floors.

NVIDIA’s stock investment implications

For traders and portfolio managers, the Nvidia-OpenAI partnership is both an opportunity and a warning. In the short term, momentum remains firmly on Nvidia’s side, and AI-related equities are likely to continue benefiting from investor enthusiasm. Over the medium term, however, valuation pressures, regulatory uncertainty, and delivery delays could cap gains.

In the long run, if AI adoption accelerates as OpenAI and Nvidia expect, the company could indeed enter a supercycle that reshapes global markets. Yet the same dominance that makes Nvidia attractive also makes it a target for regulators and competitors alike.

The performance figures quoted are not a guarantee of future performance.