Silver prices hit 14-year highs driving a potential commodities rally

Data shows silver has surged to $40.80 per ounce in 2025, its highest level in 14 years. The move raises a critical question for investors. Will silver push through the $50 threshold or stall before its next major leg higher? At the same time, the S&P 500-to-Commodity Index ratio has reached a record 17.27, showing commodities are trading at one of their steepest discounts to equities in decades. According to analysts, this divergence suggests a broader commodity rebound could be taking shape, with silver positioned at the forefront.

Key takeaways

- Silver trades at $40.80, up over 30% year to date, its strongest performance since 2011.

- The S&P 500-to-Commodity Index ratio has tripled since 2022, signalling extreme equity outperformance relative to raw materials.

- Gold-silver ratio remains stretched at 88, far above the long-term average of 60, pointing to continued undervaluation.

- Speculative demand is rising, with net long futures positions in silver up 163% in 2025.

- Silver faces a persistent supply deficit, with the Silver Institute reporting a 184.3 million ounce shortfall in 2024.

- Risks include a rebound in the US dollar, slower demand in China, and short-term overbought conditions.

Commodities appear stretched against equities

The S&P 500-to-Commodity Index ratio has reached 17.27, one of its highest readings in decades. Since the 2022 bear market, US equities have soared by 71% while the global Commodity Price Index has dropped 31%.

The divergence now surpasses the levels seen during the 2000 dot-com bubble, a period marked by equity overvaluation and eventual reversal. Historical cycles show that when this ratio becomes overstretched, capital often rotates from equities into commodities. Wells Fargo has already cautioned investors about trimming equity exposure, suggesting that quality bonds and commodity allocations could provide better risk-adjusted returns.

Silver broke $40 per ounce, marking a record surge

Silver has broken above $40 for the first time since September 2011, consolidating near $40.80. The breakout has been supported by a weaker US dollar - down 9.79% year to date - and growing expectations of Federal Reserve rate cuts in September 2025.

Futures markets show investors are aggressively positioning for further gains, with net long positions surging 163% in the first half of the year. Despite the rally, silver remains undervalued relative to gold, with the gold-silver ratio at 88 compared to a historical mean of around 60. This implies significant upside potential if silver begins to close the valuation gap.

Industrial demand for silver stands out in the commodity complex

Silver is unique because it straddles two markets: industrial demand and safe-haven investment. Industrial use continues to expand, and silver is critical for solar panels, electric vehicles, and AI-driven electronics.

The global push toward renewable energy means consumption is set to grow, with solar panel manufacturing alone expected to increase silver demand significantly in 2025. At the same time, geopolitical tensions are reinforcing silver’s safe-haven role.

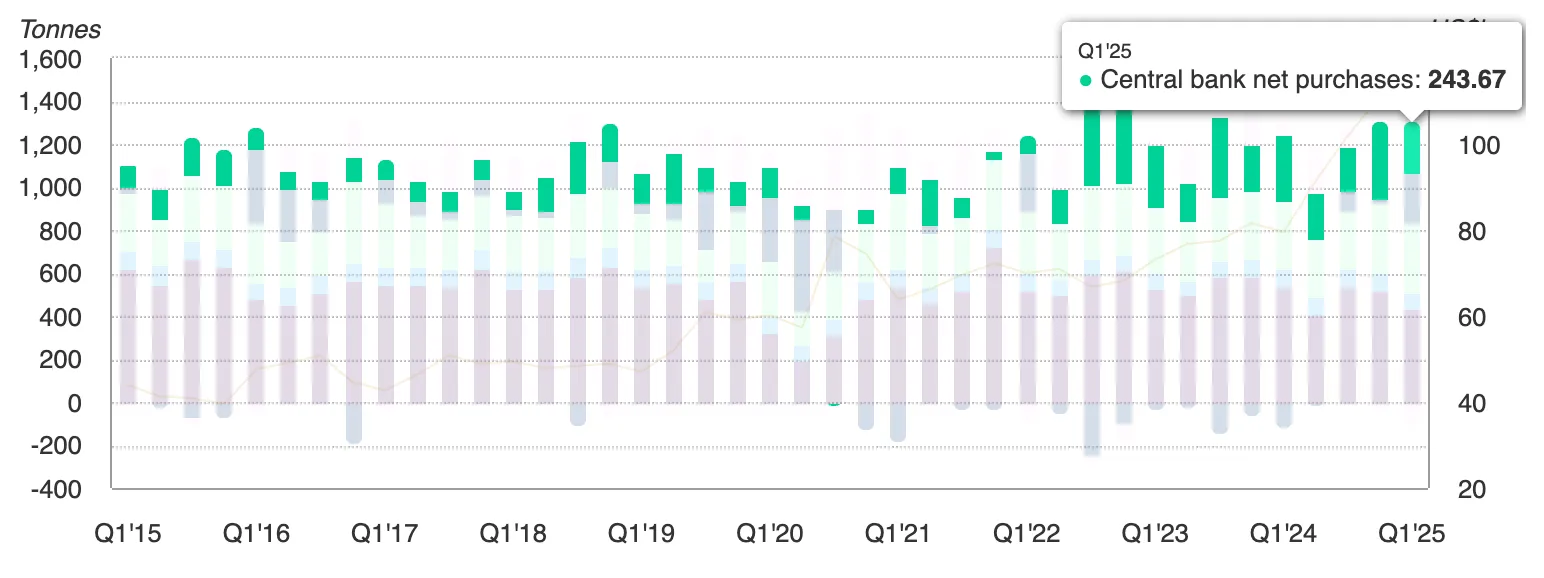

Central banks added 244 tonnes of gold in Q1 2025, and silver often follows gold during periods of monetary and political stress.

With inflation still above 2% and monetary easing on the horizon, silver is benefiting from both structural and cyclical demand drivers.

Risks to the rally

Silver’s 30% year-to-date rally raises concerns about overbought conditions in the short term. Technical indicators suggest the market could face pullbacks before mounting another leg higher.

A stronger US dollar remains a key risk, particularly if DXY returns to the 100–110 range. Weakening demand in China or advanced economies would also hurt silver’s industrial side, especially in electronics and renewables. These risks suggest silver’s path to $50 may not be linear, but the broader macro and supply-demand picture remains supportive.

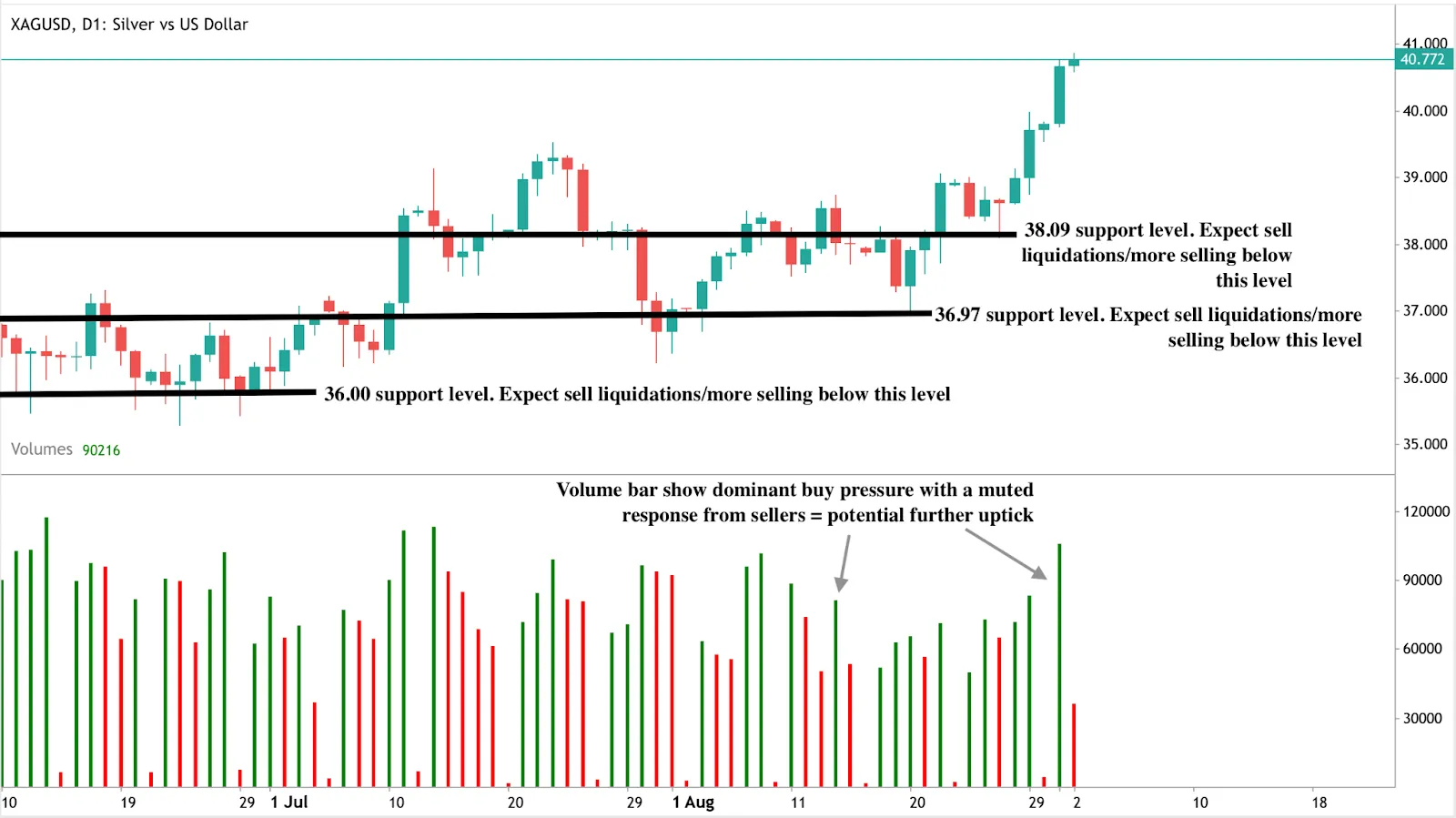

Silver technical analysis

At the time of writing, silver is in price discovery mode with potential higher highs in sight. The volume bars showing dominant buy pressure support this bullish narrative. If the rally extends, the industrial metal could test $45 on the way to $50. Conversely, if selling pressure emerges, immediate support sits at $38.09, with deeper pullbacks potentially holding at $36.97 and $36.00. These levels are crucial for traders monitoring downside risk, as they mark the floors where buyers may attempt to re-enter the market.

Investment implications

For traders, silver’s breakout above $40 confirms bullish momentum, but the metal’s high volatility means risk management is essential. Short-term strategies may focus on buying dips near support levels at $38.09, $36.97, and $36.00, with upside targets at $45 and $50. A breakout above $50 would mark a structural shift in silver’s long-term trend and could invite further speculative inflows.

For medium - to long-term investors, silver’s undervaluation relative to gold and equities, combined with structural supply deficits, supports holding exposure as part of a broader commodity allocation. Silver-linked ETFs, mining equities, and commodity baskets that include precious and industrial metals offer ways to capture upside.

For portfolio managers, the extreme S&P 500-to-Commodity Index ratio suggests it may be prudent to trim equity exposure and rebalance into undervalued commodities. Silver, with its unique mix of industrial growth demand and safe-haven qualities, stands out as a leading candidate for outperformance if the next commodity cycle begins in 2025.

Disclaimer:

The performance figures quoted are not a guarantee of future performance.