Markets react after Fed cut as volatility surges

.png)

The Federal Reserve cut interest rates for the third time this year, lowering the federal funds rate to 3.5%–3.75% and signalling a slower, more uncertain path ahead. Markets responded in sharply contrasting ways. Bitcoin plunged more than $2,000 in 24 hours before rebounding, while gold surged toward $4,235 and equities rallied. With official data still patchy after the six-week government shutdown, the Fed is navigating a delicate moment marked by inflation at 3% and a deeply divided committee.

These cross-asset swings matter because they reveal how sensitive investors have become to even minor shifts in Fed signalling. With Powell insisting the bank is “well positioned to wait and see,” the focus now shifts to how this cut shapes expectations well into 2026.

What’s driving the Fed’s hawkish cut

The Fed opted for a 25-bps reduction - below the 50-bps some traders had hoped for - reflecting an attempt to maintain optionality while inflation remains stubborn. Polymarket odds approached 99% for a cut hours before the announcement, yet the lighter move triggered immediate volatility. Bitcoin slid $500 within minutes of the decision before stabilising. Crypto markets are especially reactive, though some analysts argue that “speculative excess has been flushed out,” citing a systemic leverage ratio down to 4–5% from 10% in the summer.

Politics also looms large. Jerome Powell has only three meetings left before President Trump appoints a new chair, likely someone favouring lower rates. Prediction markets, according to Kaishi, give Kevin Hassett a 72% chance. This dynamic forces policymakers to balance economic judgment with heightened political scrutiny, complicating how they frame future guidance.

Why it matters

A rare 9–3 split exposed deep fissures within the FOMC. Governor Stephen Miran wanted a larger half-point cut, while Jeffrey Schmid and Austan Goolsbee voted to hold rates steady. Such mixed dissents - from both hawks and doves - signal a committee struggling to find common ground. Anna Wong, chief US economist at Bloomberg Economics, described the statement’s tone as “leaning dovish,” a relief for traders who feared a hawkish message with no promise of further easing.

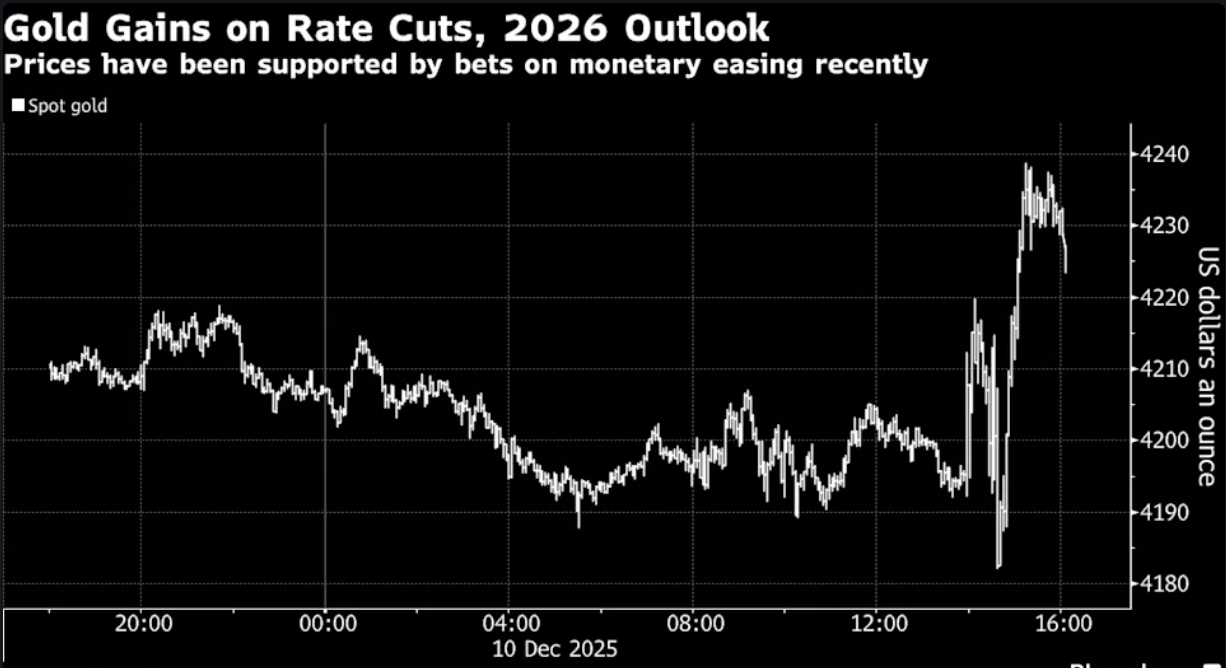

The tension is spilling into markets. Bitcoin’s swings reflect the mismatch between investor optimism and Fed caution. Gold’s surge demonstrates how traders tend to lean into havens when policy direction is uncertain.

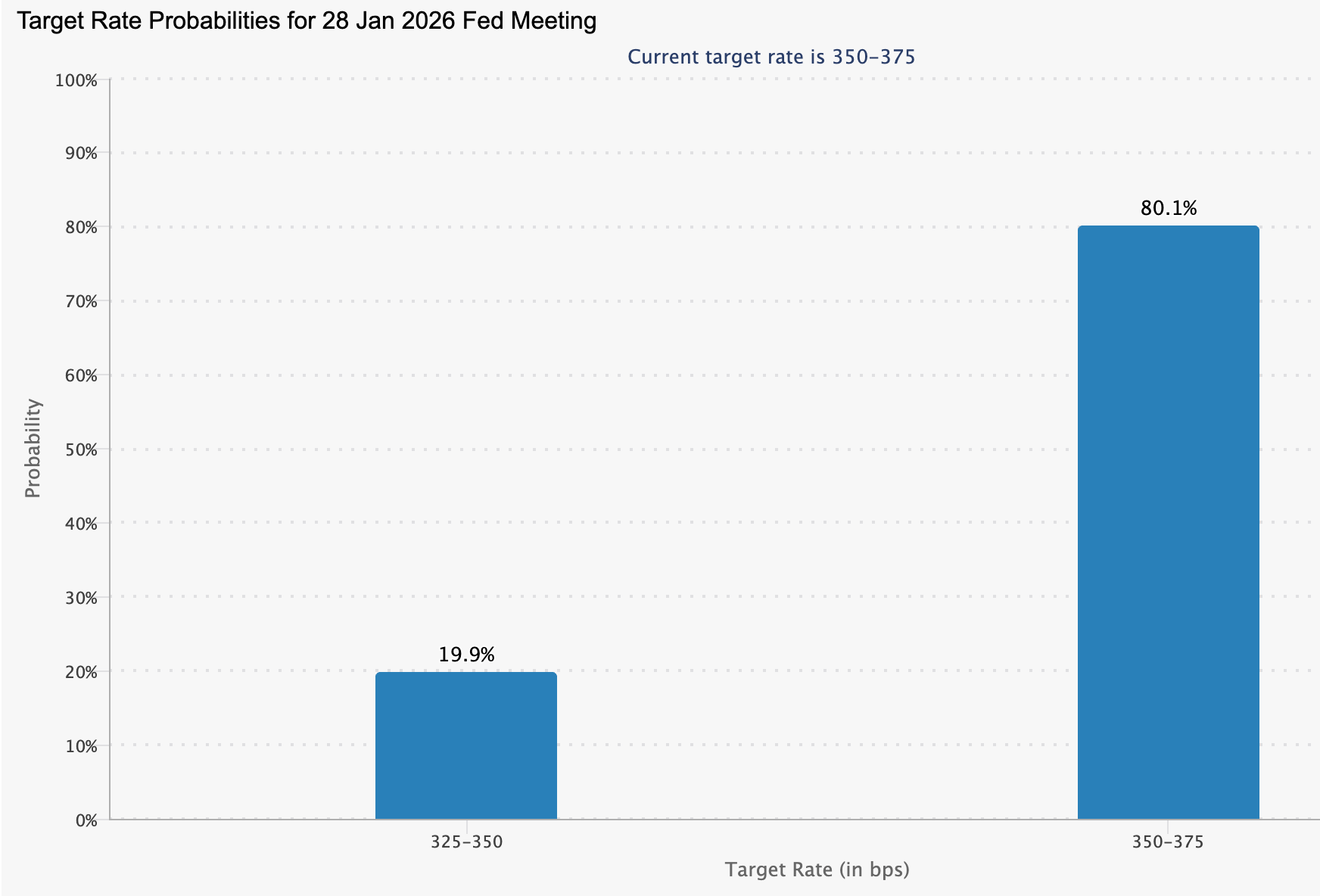

At the same time, official projections still foresee only one cut in 2026, unchanged from September, despite markets continuing to price two. This divergence makes every future Fed communication a potential source of volatility.

Impact on markets, businesses, and consumers

Crypto markets bore the brunt of the reaction. Bitcoin’s $2,000 slide over 24 hours reflects not just rate expectations but broader fragility in sentiment. Yet Coinbase’s stabilising leverage ratio suggests that the market’s structure is healthier now than during the summer’s speculative peaks. Volatility may remain elevated as traders digest the Fed’s slower pace of easing.

Gold extended its rally to the $4,230 region before a slight pullback, as lower yields reduced the opportunity cost of holding non-yielding assets. The CME FedWatch tool indicates an 80% chance that the Fed will hold rates steady in January, up from 70% prior to the announcement.

Bart Melek of TD Securities said the Fed’s upcoming $40 billion monthly T-bill purchases resemble “mini-quantitative easing,” supporting gold into early 2026. Silver surged to a record $61.8671 amid lingering supply tightness, more than doubling this year and outpacing gold’s 59% rise.

FX markets absorbed both sides of the Atlantic. EUR/USD steadied as traders processed the Fed split and Lagarde’s optimistic tone. A stronger euro often emerges when investors expect the ECB to pause cuts sooner, and the implication that eurozone growth will outperform earlier forecasts reinforces this shift. If the ECB faces less pressure to ease further, USD strength may continue to soften - especially in a scenario where the incoming Fed chair proves more dovish.

Geopolitics added another layer. Reports suggest President Trump has given Ukraine’s Volodymyr Zelensky a Christmas deadline to accept a peace framework with Russia. Any progress could dampen safe-haven demand, though for now, the combination of liquidity support and policy uncertainty keeps bullion elevated.

For households and businesses, the message is mixed. Rates may stay lower for longer, but borrowing costs - mortgages, loans, credit cards - remain high relative to pre-inflation norms. Announced layoffs exceeding 1.1 million this year hint at softening labour conditions despite limited official data.

Expert Outlook

Powell emphasised that the Fed needs time to assess how the three 2025 cuts filter through the economy. While GDP growth for 2026 was upgraded to 2.3%, inflation is not projected to return to target until 2028. Markets still expect two cuts in 2026, with the next priced for June, putting investor expectations and Fed messaging on divergent paths.

The January meeting won’t necessarily shift policy, but it will be critical for resetting communication. Traders will watch how Powell interprets incoming labour and inflation data, how liquidity injections unfold, and whether uncertainty around the incoming Fed chair reshapes expectations. Until then, volatility across crypto, commodities, and bonds is likely to remain elevated.

Key Takeaway

The Fed’s 25 bps cut may look straightforward, but its implications are anything but. A divided committee, persistent inflation, political pressure, and delayed data have created fertile ground for volatility. Bitcoin’s severe swings, gold’s surge, and shifting rate expectations all reflect a market recalibrating to a slower and more uncertain easing cycle. The January meeting will offer the next crucial clues on whether the Fed stays cautious or feels compelled to shift course.

Gold and Silver technical insights

Gold is trading just below the US$4,240 resistance zone, where recent candles show hesitation and mild profit-taking. The Bollinger Bands have tightened, signalling a volatility squeeze that typically precedes a decisive breakout. The price is holding above the US$4,190 support, but a close below this level could trigger liquidation-driven selling towards US$4,035. Meanwhile, the RSI sits gently above the midline, indicating a slight bullish bias without overbought pressure. A break above US$4,240 opens the door to US$4,365, while failure to hold US$4,190 risks a deeper corrective move.

Disclaimer:

EU: The performance figures quoted are not a guarantee of future performance. The future performance figures quoted are only estimates and may not be a reliable indicator of future performance.

ROW: The performance figures quoted are not a guarantee of future performance.