ইথেরিয়ামের মূল্য ক্র্যাশ: আমরা কি ক্রিপ্টো শীতকালে নাকি কেবল মুনাফা নেওয়ার পর্যায়ে?

3,500 ডলারের নিচে ইথেরিয়ামের তীব্র পতন একটি ক্রিপ্টো শীতের শুরুর মতো কম এবং আরও বড় আকারের মুনাফা গ্রহণের রিসেটের মতো দেখাচ্ছে। অন-চেইন, ডেরিভেটিভস এবং প্রাতিষ্ঠানিক প্রবাহ জুড়ে ডেটা বোঝায় যে দীর্ঘায়িত বিয়ারিশ চক্রে প্রবেশের পরিবর্তে কয়েক মাসের আক্রমণাত্মক লাভের

খুচরা ব্যবসায়ীরা এবং এক্সচেঞ্জ-ট্রেডেড তহবিল (ইটিএফ) ভয় দেখাচ্ছে, তখন তিমি এবং প্রাতিষ্ঠানিক ট্রেজারি পুলব্যাক জমা করতে ব্যবহার করছে - ইঙ্গিত দেয় যে বর্তমান পর্যায়টি বছরের শেষের দিকে পুনরুদ্ধারের ভিত্তি স্থাপন করতে পারে।

মূল টেকওয়ে

- ইথেরিয়াম প্রায় 3,312 ডলারে ট্রেড করে, যা গত মাসে 8.92% কমেছে।

- ১.১ বিলিয়ন ডলারের বেশি লিভারেজড পজিশনগুলি 24 ঘন্টার মধ্যে লিকুইডেট করা হয়েছিল, কারণ 303,000 ব্যবসায়ীকে বাধ্য করা হয়েছিল।

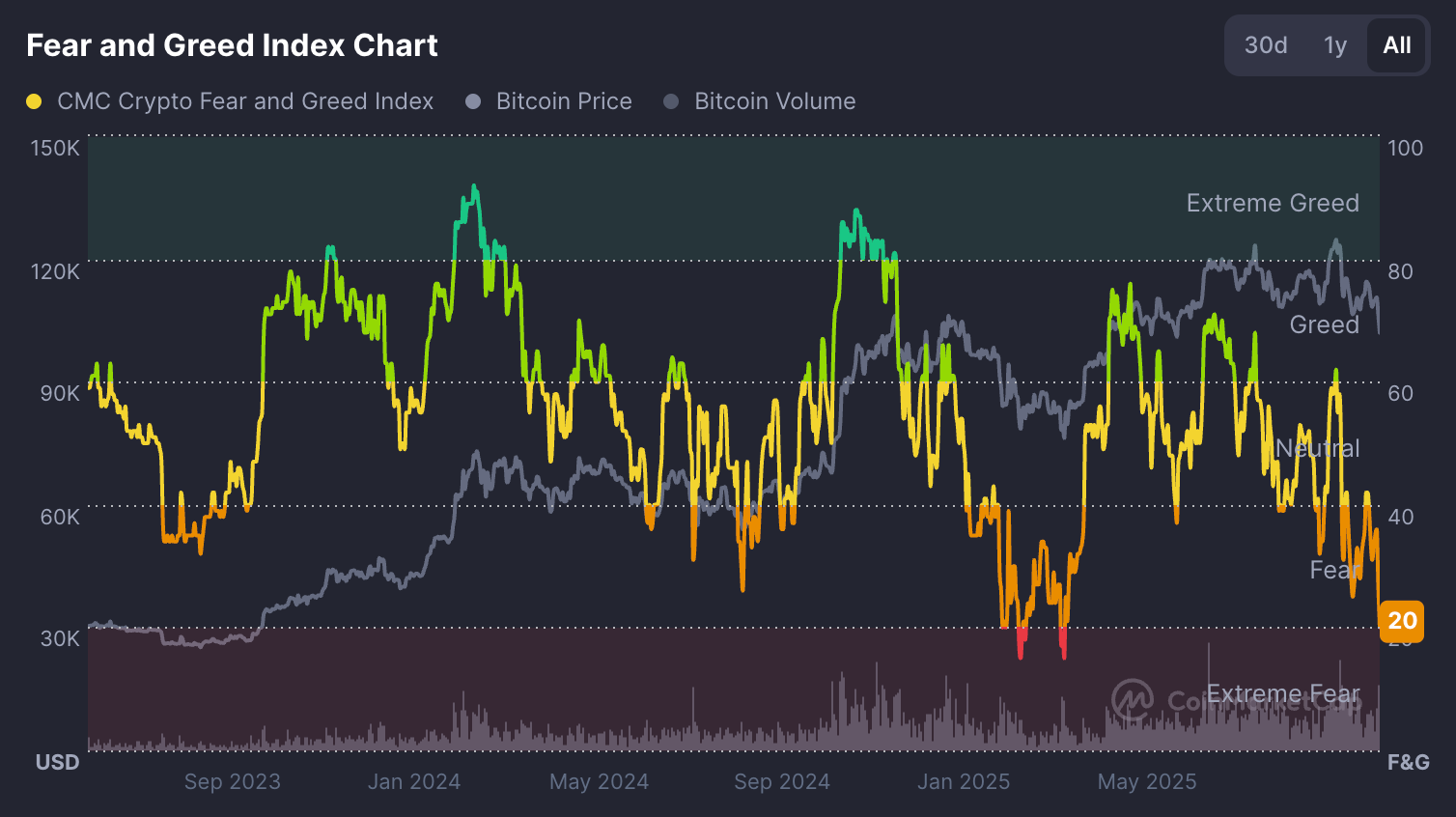

- ক্রিপ্টো ফিয়ার অ্যান্ড গ্রীড সূচক এক মাস আগের 59 (“লোভ”) থেকে নেমে 20 (“ভয়”) এ নেমে গেছে।

- তিমির ওয়ালেটগুলি দাম হ্রাস সত্ত্বেও অক্টোবরে 1.64 মিলিয়ন ETH (~ 6.4 বিলিয়ন ডলার) যুক্ত করেছে।

- 3 ডিসেম্বর 2025 এর জন্য নির্ধারিত ফুসাকা হার্ড ফর্ক আপগ্রেডটি পিয়ারডাস চালু করে, যা লেয়ার-2 ফি 95% পর্যন্ত হ্রাস করবে বলে আশা করা হচ্ছে।

- গত আট বছরে +6.9% গড় রিটার্ন সহ নভেম্বর ঐতিহাসিকভাবে ইথেরিয়ামের সেরা পারফরম্যান্স মাস ছিল।

ক্রিপ্টো মার্কেটের অনুভূতি ভয়কর হয়ে যায়

ক্রিপ্টো ফিয়ার অ্যান্ড গ্রীড সূচক 20 এ নেমে গেছে, যা বিনিয়োগকারীদের মধ্যে ব্যাপক অস্বস্তির ইঙ্গিত

মাত্র এক মাস আগে, 50 এর উপরে রিডিং মাঝারি লোভ দেখিয়েছিল। ব্যবসায়ীরা আশাবাদ থেকে সতর্কতার দিকে যাওয়ার সাথে সাথে এই শিফটটি অনুভূতির একটি নাটকীয় পরিবর্তনের

বিস্তৃত বাজার জুড়ে, প্রায় প্রতিটি বড় সম্পদ লাল হয়ে গেছে। বিটকয়েন 2.8% কমেছে 104,577 ডলারে, সোলানা 11% হ্রাস পেয়েছে, বিএনবি 8.3% হারিয়েছে, এক্সআরপি 6.7% কমেছে এবং কার্ডানো গত 24 ঘন্টায় 7.4% কমেছে। মোট ক্রিপ্টোকারেন্সি মার্কেট ক্যাপ প্রতিদিন 4% হ্রাস পেয়েছে, 140 বিলিয়ন ডলারের বেশি মূল্য মুছে ফেলেছে।

ম্যাক্রো ব্যাকড্রপ চাপকে যৌগ করে। ফেডারেল রিজার্ভের অনিশ্চিত হারের দৃষ্টিভঙ্গি এবং একটি শক্তিশালী মার্কিন ডলার ঝুঁকিপূর্ণ সম্পদ থেকে তরলতা নিষ্কাশন করছে - একটি গতিশী

খুচরা প্রত্যাহার করার সময় ETH তিমির জমা তীব্র হয়

যদিও ভয় শিরোনামে আধিপত্য বিস্তার করে, ব্লকচেইন ডেটা প্রকাশ করে যে বৃহত্তম ধারকরা চুপচাপ বিশ্লেষণ সংস্থা স্যান্টিমেন্টের মতে, অক্টোবর মাসে 1,000 থেকে 100,000 ইটিএইচের মধ্যে থাকা ওয়ালেটগুলি তাদের ভারসাম্য 99.28 মিলিয়ন থেকে 100.92 মিলিয়ন ইটিএইচে বৃদ্ধি করেছিল।

এই কেনাকাটা ঘটেছিল এমনকি সেই মাসে ইথেরিয়াম প্রায় 7% কমেছে - এটি একটি শক্তিশালী লক্ষণ যে প্রাতিষ্ঠানিক এবং উচ্চ-নেট-মূল্যবান বিনিয়োগকারীরা বর্তমান দামগুলি

বিপরীতে, দীর্ঘমেয়াদী খুচরা সংগ্রহ ধীর হয়েছে গ্লাসনোড ডেটা দেখায় যে অক্টোবরের শেষের দিকে হোল্ডার অ্যাকমিউলেশন রেশিও 31.27% থেকে 30.45% হ্রাস পেয়েছে।

খুচরা বিনিয়োগকারীরা এক্সপোজার হ্রাস করছেন, পুনরায় প্রবেশের আগে তিমি কেনা এবং খুচরা সতর্কতার মধ্যে এই বিভ্রান্তি বর্তমান সংশোধনের সংজ্ঞায়িত বৈশিষ্ট্য হয়ে উঠেছে।

প্রাতিষ্ঠানিক অবস্থান: ইটিএফ এবং ট্রেজারি পৃথক

প্রাতিষ্ঠানিক প্রবাহ একটি মিশ্র ছবি আঁকা একদিকে, মার্কিন স্পট ইথেরিয়াম ইটিএফগুলি 3 নভেম্বর 135.76 মিলিয়ন ডলার আউটফ্লোতে অভিজ্ঞতা অর্জন করেছে।

- ব্ল্যাকরকের ইটিএইচএ: -$81.7 মিলিয়ন

- ফিডেলিটির ফেইটিএইচ: -$25.1 মিলিয়ন

- গ্রেস্কেলের ETHE: -$15 মিলিয়ন

এই রিডিম্পশনগুলি বিটকয়েন ইটিএফ আউটফ্লোতে $186.5 মিলিয়ন পাশাপাশি এসেছে, কারণ প্রাতিষ্ঠানিক ডেস্কগুলি উচ্চতর অস্থিরতার মধ্যে এক্সপোজার

অন্যদিকে, কর্পোরেট ট্রেজারি জমা হচ্ছে। পাবলিকভাবে ট্রেড করা বিটমাইন ইমারশন টেকনোলজিস (বিএমএনআর) গত সপ্তাহে 82,353 ETH যোগ করেছে - মূল্য প্রায় 294 মিলিয়ন ডলার - এর মোট হোল্ডিংস 3.39 মিলিয়ন ETH বা ইথেরিয়ামের সঞ্চালন সরবরাহের 2.8% এ নিয়ে আসে সংস্থার গড় ক্রয় মূল্য প্রায় 3,909 ডলার, যা দীর্ঘমেয়াদী উন্নতির আস্থা দেয়।

বিএমএনআর-এর চেয়ারম্যান টম লি সিএনবিসিকে বলেছিলেন যে বাজারটি “রিসেটের পরে একীভূত হচ্ছে” এবং যোগ করেছেন যে স্টেবলকোইন ভলিউম এবং অ্যাপ্লিকেশন উপার্জনের মতো মৌলিক বিষয়গুলি সর্বকালের উচ্চতায় রয়েছে। লি বছরের শেষের আগে ইথেরিয়ামের জন্য 7,000 ডলারের দিকে সম্ভাব্য বৃদ্ধির পূর্বাভাস দিয়েছেন, বর্তমান পরিস্থিতিকে সংকটের পরিবর্তে স্বাস্থ্যকর সংশোধন হিসাবে তৈরি করেছেন।

লিকুইডেশন একটি বাজার রিসেট প্রকাশ করে

সংশোধনের সবচেয়ে নাটকীয় সংকেত ডেরিভেটিভস বাজার থেকে এসেছিল। কয়েনগ্লাসের তথ্য দেখায় যে মাত্র 24 ঘন্টার মধ্যে 303,000 টিরও বেশি ব্যবসায়ী লিকুইডেট হয়েছিল, যার ফলস্বরূপ জোরপূর্বক অবস্থানে মোট $1.1 বিলিয়ন ডলার হয়েছিল। এক ঘন্টার মধ্যে, 300 মিলিয়ন ডলারেরও বেশি মুছে ফেলা হয়েছিল - যার মধ্যে 287 মিলিয়ন ডলার লং পজিশন ছিল।

লিকুইডেশনের এই স্কেলটি প্রকাশ করে যে কীভাবে দামগুলি মূল সমর্থন স্তরের নিচে ভেঙে গেলে ওভার-লিভারেজড বুলিশ বেট ইথেরিয়াম এবং বিটকয়েন ওয়াইপআউটের বেশিরভাগ অংশই ছিল, অন্যদিকে সোলানা এবং বিএনবির মতো উচ্চ-বিটা আল্টকয়েন আরও তীক্ষ্ণ হ্রাস পেয়েছে।

ফলাফলটি বিপরীতভাবে গঠনমূলক: লিভারেজ পরিষ্কার করা হয়েছে, তহবিলের হার স্বাভাবিক হয়েছে এবং উন্মুক্ত সুদ এখন অনুমানমূলক অতিরিক্ত পরিবর্তে শৃঙ্খলা জমা প্রতিফলিত করে। ইথেরিয়ামের উন্মুক্ত সুদ 19.9 বিলিয়ন ডলারে বেশি থাকে তবে তহবিলের হার সমতল - এমন একটি ভারসাম্য যা প্রায়শই আরও স্থিতিশীল পুনরুদ্ধারের পর্যায়ের আগে থাকে।

ফুসাকা আপগ্রেড দীর্ঘমেয়াদ

স্বল্পমেয়াদী ব্যবসায়ীরা দামের অস্থিরতার প্রতি প্রতিক্রিয়া জানালেও বিকাশকারীরা এখনও ইথেরিয়ামের অন্যতম উচ্চা

ফুসাকা হার্ড ফর্ক, 3 ডিসেম্বর 2025 এর জন্য নিশ্চিত, পিয়ার ডেটা উপলভ্যতা স্যাম্পলিং (পিয়ারডাএস) চালু করে - এমন একটি প্রযুক্তি যা ব্লক ক্ষমতা প্রতি ব্লক 6 থেকে 48 পর্যন্ত বাড়ায়। এই আপগ্রেডটি লেয়ার-2 লেনদেনের ফি 95% পর্যন্ত হ্রাস করতে পারে, যা DeFi এবং রোলআপ নেটওয়ার্কগুলির জন্য স্কেলেবিলিটি উল্লেখযোগ্যভাবে উন্নত করতে

এই জাতীয় অবকাঠামোগত উন্নতিগুলি বিকল্প লেয়ার-১ চেইনের বিরুদ্ধে ইথেরিয়ামের অক্টোবরে ইথেরিয়ামে স্টেবলকোইন লেনদেনগুলি 2.8 ট্রিলিয়ন ডলারে পৌঁছানোর সাথে সাথে দামের ঝামেলা সত্ত্বেও নেটওয়ার্

ইথেরিয়ামের নভেম্বর ঐতিহাসিক প্যাটার্ন: একটি বেলিশ

মৌসুমী শীঘ্রই সমর্থন দিতে পারে। গত আট বছরে, ইথেরিয়াম নভেম্বরে গড়ে +6.9% মাসিক রিটার্ন করেছে। ২০২৪ সালে, এটি একটি উল্লেখযোগ্য 47.4% র্যালি রেকর্ড করেছিল, যা এর সর্বকালের অন্যতম শক্তিশালী মাস।

নেট আনরিয়েলিজড লাভ/লস (এনইউপিএল) অনুপাত - যা মুনাফার বিনিয়োগকারীদের শতাংশ পরিমাপ করে - 0.43 থেকে 0.39 এ কমেছে, যা শেষ পর্যন্ত $3,750 থেকে $4,240 এ 13% রিবাউন্ড করেছে।

এই প্রবণতাটি পরামর্শ দেয় যে বিনিয়োগকারীদের মুনাফা নেওয়ার জন্য উত্সাহ হ্রাস পাওয়ার কারণে

ম্যাক্রো প্রসঙ্গ: মুনাফা গ্রহণ, আতঙ্কিত নয়

ইথেরিয়ামের মন্দু ঝুঁকিপূর্ণ সম্পদের বিস্তৃত আচরণকে আ ক্রিপ্টোকারেন্সি জুড়ে কয়েক মাস ডবল ডিজিটের লাভের পরে, বিশ্বব্যাপী তরলতার উদ্বেগের মধ্যে মুনাফা মার্কিন ডলার সূচক তীব্রভাবে শক্তিশালী হয়েছে ফেড কর্মকর্তারা ধীর হার হ্রাসের ইঙ্গিত দিয়েছেন, বিনিয়োগকারীদের অনুমান সম্পদ থেকে বাদ দিতে উত্সাহিত করেছেন

পূর্ববর্তী বিয়ার-মার্কেটের অবস্থার বিপরীতে, তবে নেটওয়ার্ক ক্রিয়াকলাপ বা বিকাশকারীদের ব্যস্ততায় কোনও পতন নেই। ডিএফআই রাজস্ব শক্তিশালী রয়েছে, স্টেবলকয়নের বেগ বেশি এবং তিমির প্রবাহ পিছিয়ে যাওয়ার পরিবর্তে ঘূর্ণন নির্দেশ করে। সেল-অফ, অতএব, 2022-2023 ক্রিপ্টো শীতের বৈশিষ্ট্যযুক্ত স্থায়ী মূলধন ফ্লাইটের চেয়ে লাভ-লকিং আচরণের সাথে আরও সারিবদ্ধ।

ব্যবসায়ীরা ডেরিভ এমটি 5 রিয়েল-টাইমে বিস্তৃত বাজারের অনুভূতি পরিমাপ করতে ক্রিপ্টোকারেন্সি থেকে ফরেক্স পর্যন্ত একাধিক সম্পদ জুড়ে এই শি

ইথেরিয়াম প্রযুক্তিগত অন্তর্দৃষ্টি: স্থিতিশীলতা

ইথেরিয়াম বর্তমানে $3,313 এর কাছাকাছি ট্রেড করছে, যা $3,745 সমর্থন স্তরটি পরীক্ষা করে এমন একটি তীব্র হ্রাসের পরে পুনরুদ্ধার এই অঞ্চলটি একটি মূল অঞ্চল হিসাবে কাজ করেছে যেখানে বিক্রয় লিকুইডেশন তীব্র হয়েছিল, তবে সাম্প্রতিক বাউন্স ক্রেতার আগ্রহের প্রাথমিক লক্ষণগুলি প্র

বোলিঙ্গার ব্যান্ডগুলি উল্লেখযোগ্যভাবে প্রসারিত হয়েছে, যা উচ্চতর অস্থিরতার ইঙ্গিত দেয়, যদিও দামের ক্রিয়া নিম্ন ব্যান্ডের কাছাকাছি থাকে - সাধারণত স্বল্পমেয়াদী মাঝারি ব্যান্ডের উপরে একটি স্থায়ী বন্ধ গতির পুনরুদ্ধারের নিশ্চয়তা দিতে পারে।

এদিকে, আপেক্ষিক শক্তি সূচক (আরএসআই) 33 থেকে তীব্রভাবে বেড়েছে, যা প্রায় ওভারসেলড রিডিংয়ের পরে বেলিশ গতির উন্নতির ইঙ্গিত দেয়। আরও একটি আরএসআই 50 এর উপরে যাওয়া সম্ভাব্য স্বল্পমেয়াদী বিপরীতকে শক্তিশালী

প্রতিরোধের স্তর $4,250 (যেখানে মুনাফা গ্রহণ এবং আরও ক্রয় উত্থাপিত হতে পারে) এবং $4,700 এ থাকে, যা কোনও বর্ধিত র্যালির জন্য আরও শক্তিশালী সিলিং চিহ্নিত করে। সামগ্রিকভাবে, ETH পুনরুদ্ধারের প্রাথমিক লক্ষণ দেখায় তবে এখনও সামনে শক্তিশালী

দীর্ঘমেয়াদী দৃষ্টিভঙ্গি নির্ভর করে যে ইটিএফ আউটফ্লো স্থিতিশীল হয় কিনা এবং নভেম্বর পর্যন্ত তিমির জমা হওয়ার ভয়ের মাত্রা উঁচু হওয়ার সাথে সাথে, বিপরীত ব্যবসায়ীরা অতীতের মধ্য-চক্র সংশোধনের মতো একটি সম্ভাব্য নীচের প্রক্রিয়াটি ঘনিষ্ঠভাবে দ্য ডেরিভ ট্রেডিং ক্যালকুলে এই ধরনের অস্থির পরিবেশে অবস্থান নেওয়ার আগে ব্যবসায়ীদের সম্ভাব্য লাভ এবং মার্জিন এক্সপোজার মূল্যায়ন

ইথেরিয়াম বিনিয়োগের প্র

স্বল্পমেয়াদী ব্যবসায়ীদের জন্য, ইথেরিয়ামের সেটআপটি উচ্চঅনিশ্চয়তা $3,500—$3,700 সমর্থন পরিসীমার কাছাকাছি কৌশলগত প্রবেশের সুযোগ সহ পরিবেশ। সেন্টিমেন্ট স্থিতিশীল এবং ইটিএফ আউটফ্লো ধীর হয়ে গেছে বলে মনে করা ডিসেম্বর মাসে উপরের লক্ষ্যগুলি $4,400 থেকে 4,600 ডলার মধ্যে থাকে।

মাঝারি মেয়াদী বিনিয়োগকারীদের জন্য, বর্তমান স্তরগুলি একটি জমা উইন্ডো তিমি কেনা, ফুসাকা আপগ্রেড এবং মৌসুমী নিদর্শনগুলি পৃষ্ঠের ভয়ের নীচে মৌলিক বিষয়গুলির উন্নতির দিকে সামষ্টিক অর্থনৈতিক অনিশ্চয়তা সহজ হয়ে গেলে এবং অন-চেইন স্থিতিশীলতা নিম্নরূপ নিশ্চিত হওয়ার পরে

সংক্ষেপে, ইথেরিয়ামের পতন একটি বাজারের স্বাভাবিককরণ, কোনও পতন নয়। লিভারেজ আনউইন্ডস এবং মৌলিক বিষয়গুলি শক্তিশালী হওয়ার সাথে সাথে পরবর্তী লেগ হায়ারের জন্য গ্রাউন্ডওয়ার্ক ইতিমধ্যে গঠন হতে

উদ্ধৃত পারফরম্যান্স পরিসংখ্যানগুলি ভবিষ্যতের পারফরম্যান্সের গ্যারা