Bitcoin price breaches $85,000 as crypto enters a new phase

Bitcoin just hit $85,000, and the crypto world is buzzing with bullish energy. It’s not just a number-it’s a signal. A signal that momentum is building, whales are stirring, and the crypto market might be stepping into a new era.

But with all this hype, we’ve got to ask: is this a breakout or a bluff?

Bitcoin leads the charge

Bitcoin’s recent surge to $85K marks one of its most significant price moves. That puts it up 13.4% from its monthly low, even as it trades just shy of the key resistance level at $85,000. Yet, despite the excitement, BTC remains under its 50-day moving average - a sign that not everyone’s convinced this rally has legs.

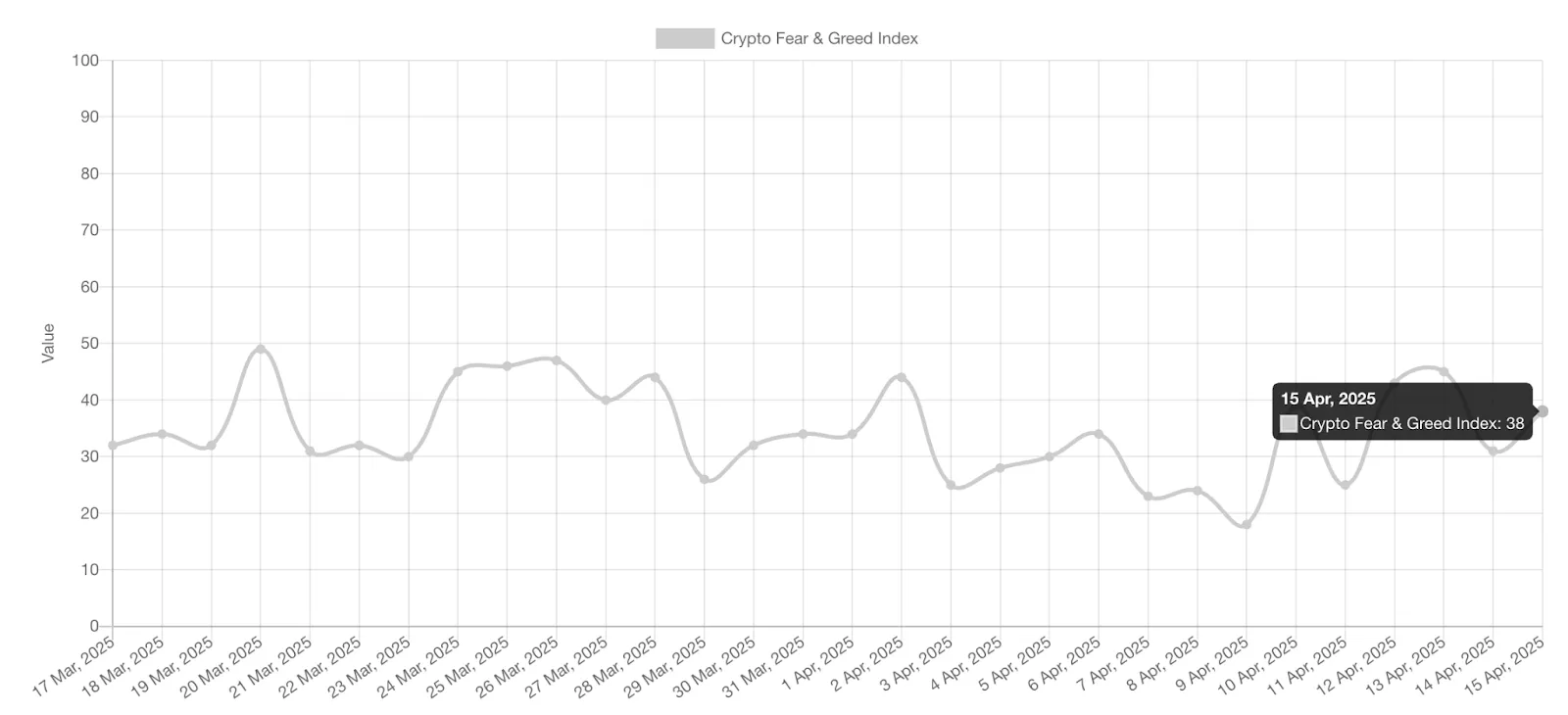

Market mood? Still cautious. The crypto Fear & Greed Index is parked at 38, firmly in the “fear” zone.

CNN’s version takes it further, clocking in at 21 "extreme fear."

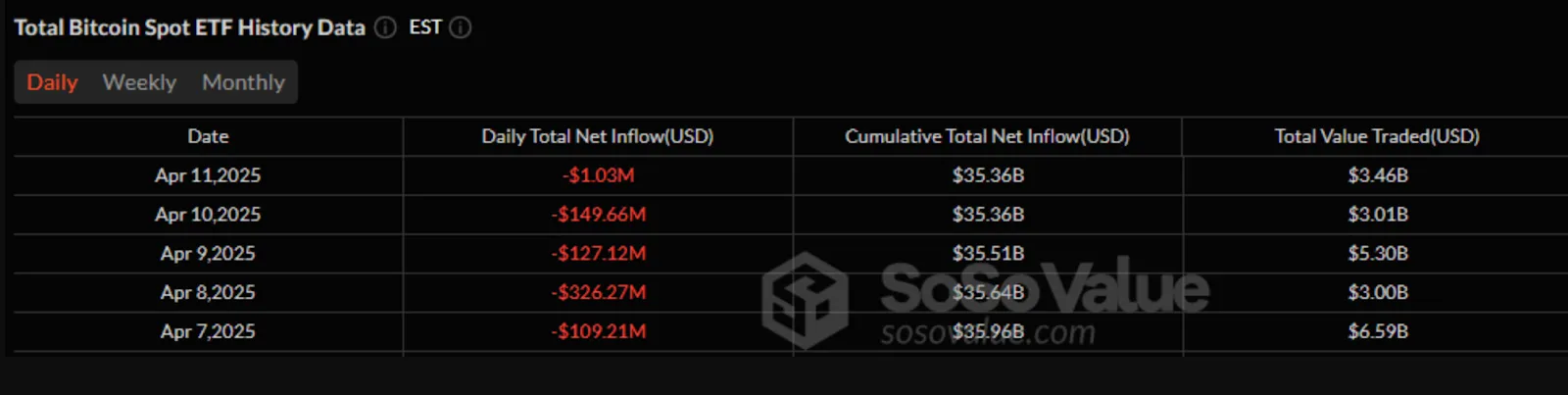

Spot Bitcoin ETFs haven’t helped, logging $713 million in outflows last week and $172 million the week before.

Traders are sitting on the sidelines, waiting for clearer skies.

So why the surge?

Thank the macro drama. President Trump recently announced a 90-day suspension on certain tariffs, sparing smartphones, semiconductors, and other tech gear. The Nasdaq 100 jumped on the news - then cooled off. Still, crypto liked what it saw. Liquidity came back, and risk appetite started to rise.

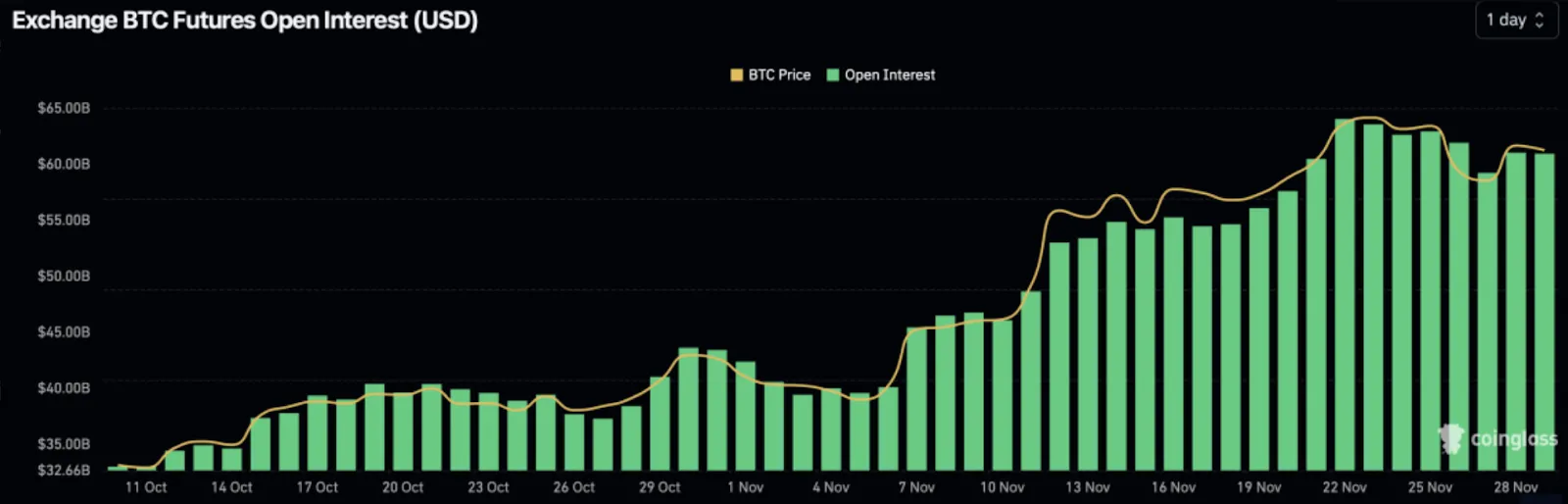

Open interest in Bitcoin futures remains flat at $60 billion, signalling a bit of hesitation among derivatives traders. But whales? They’re paying attention. Market watchers saw increased wallet activity around the $84K mark, with some big players possibly accumulating BTC in anticipation of further gains.

Ripple Hidden Road acquisition

While Bitcoin was grabbing headlines, Ripple decided to steal a little spotlight. The crypto firm is acquiring Hidden Road - a major brokerage that processed $3 trillion in transfers last year - for a staggering $1.25 billion. The deal will close by Q3 2025 and includes a clever twist: it’s being paid for with cash, Ripple equity, and XRP tokens.

That’s right. XRP isn’t just along for the ride - it’s part of the engine.

XRP whale accumulation

XRP has been moving too, rising to $2.15 during Monday’s early European session. With $2.00 acting as a strong support level, whales have been taking advantage of recent dips. Santiment reports wallets holding between 1 million and 100 million XRP now control over 20% of the total supply. That’s not just noise - that’s conviction.

The big driver? Again, it’s the U.S. tariff saga. Trump's 90-day pause on new duties boosted sentiment across markets. Even though the exemptions aren’t permanent and fentanyl-related tariffs are still in place; the temporary relief gave crypto whales a reason to start buying again.

Ripple’s acquisition isn’t just about buying a brokerage - it’s about planting a flag in institutional finance. Coin Bureau CEO Nic Puckrin calls it a "watershed moment," when crypto stops knocking on TradFi’s door and starts owning the building.

Hidden Road’s infrastructure gives Ripple a fast track into the institutional plumbing that runs global finance. The use of XRP in the deal sends a message too: this isn’t just about tokenomics; it’s about trust.

Legal win in sight?

Ripple is also nearing the end of its years-long legal clash with the SEC. Both sides filed to dismiss remaining appeals, and a $50 million settlement is on the table - down from the original $125 million. Ripple CEO Brad Garlinghouse framed it as a victory, signaling a more favourable regulatory landscape ahead.

Technical outlook: Crypto market in a new phase?

Bitcoin’s breakout and Ripple’s institutional push paint a clear picture: crypto is no longer just a fringe experiment. With whales accumulating, macro conditions shifting, and major players like Ripple executing billion-dollar deals, this market matures quickly.

Whether you’re a trader, an investor, or just crypto-curious, the question now is what’s next. Could Bitcoin push beyond $90K? Will XRP’s ecosystem become an essential infrastructure for TradFi? And how will regulation continue to shape the path forward?

At the time of writing, BTC is hovering around the $85,500 price level with some bullish indicators present, as the RSI mildly rises just above the midline. However, prices remain below the moving average as they tower towards the upper Bollinger band - an indicator of overbought conditions.

Key levels to watch on the upside are $87,400 and $91,000, and on the downside, the key levels are $81,800 and $78,800.

XRP has also been on the rise, though it is currently flat-lining. Prices remaining below the moving average suggest that the overall trend is still downwards unless we see significant momentum building. Should we see a surge, key levels to watch are $2.252 and $2.400. If we see a significant slide, prices could find support at the $2.000 mark.

Ready to position yourself in this changing landscape? You can speculate on BTC and XRP with a Deriv MT5 or Deriv X account.

Disclaimer:

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice.

This information is considered accurate and correct at the date of publication. No representation or warranty is given as to the accuracy or completeness of this information.

The performance figures quoted are not a guarantee of future performance or a reliable guide to future performance. Changes in circumstances after the time of publication may impact the accuracy of the information.

Trading is risky. We recommend you do your own research before making any trading decisions.