如何在 Deriv 交易大宗商品

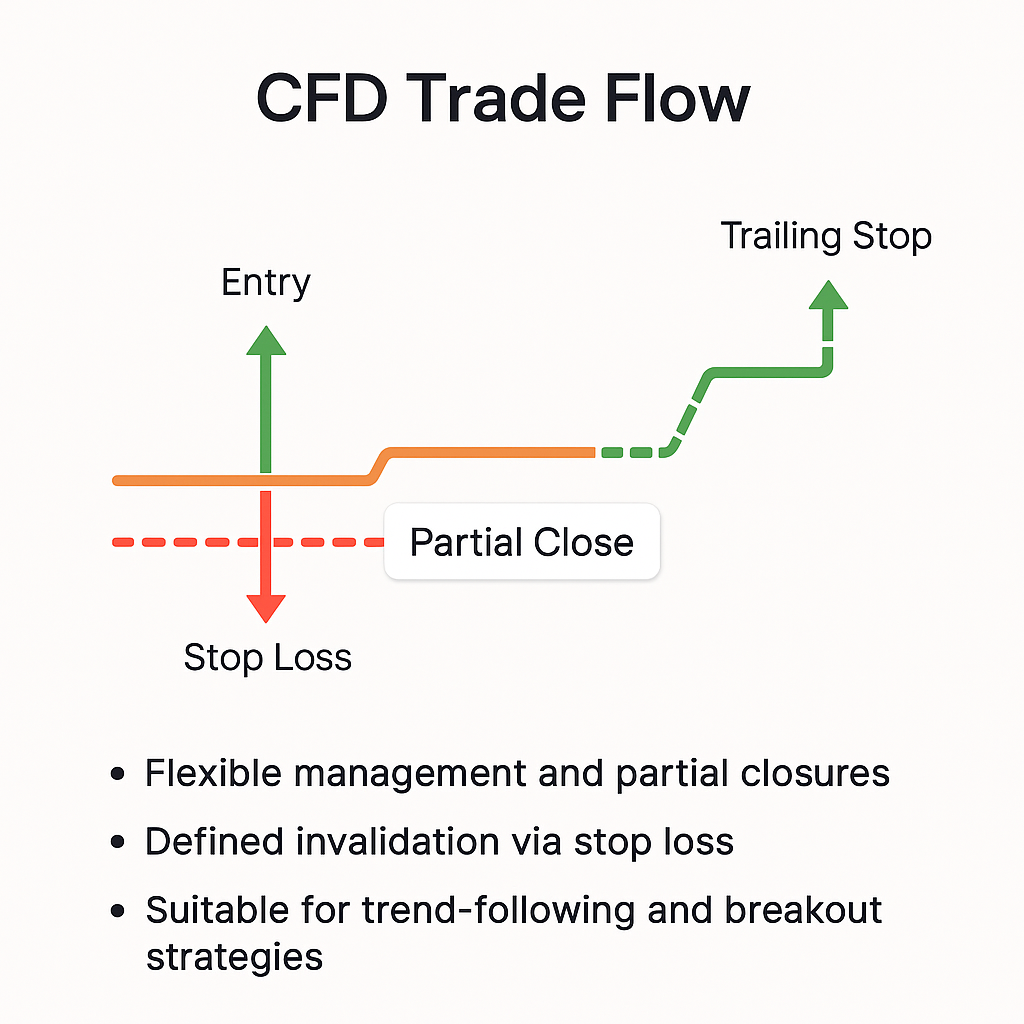

在 Deriv 进行大宗商品交易,为交易者提供了通过两种主要工具——差价合约(CFD)和数字期权——参与能源、金属及部分软商品价格波动的机会。自 2026 年及以后,Deriv 提供了一系列平台——Deriv MT5、Deriv cTrader、Deriv Trader、SmartTrader、Deriv Bot 和 Deriv GO——以支持各种交易风格。CFD 允许通过止损、部分平仓和跟踪止损灵活管理持仓,而期权则基于价格方向或价格水平结果,提供固定风险的合约。

快速摘要

- 石油和黄金等大宗商品对供需和宏观经济因素有反应。

- CFD 适合持仓数小时或数天的交易者。

- 数字期权常被交易者用于表达短线或基于价格水平的观点,每份合约风险预先设定。

- 保持一致的仓位规模和关注事件风险有助于负责任的交易。

如何在 Deriv 交易大宗商品

CFD(Deriv MT5、Deriv cTrader)

你交易的是价格波动,而不是实物商品。CFD 让你可以开放式地管理交易:通过止损定义风险,逐步加仓,部分获利,并跟踪盈利头寸。

优势:

- 灵活管理和部分平仓。

- 通过止损明确无效点。

- 适用于趋势跟随和突破策略。

实用示例:一位分析美国原油(WTI 原油)的交易者发现价格突破阻力。在 Deriv MT5 上,他在该水平上方稍微设置买入止损单,在前一波动低点下方设定止损,并利用 Deriv GO 警报管理跟踪止损,同时监控风险。这种结构化方法有助于在不同交易时段保持一致性,尽管结果仍取决于市场状况。

风险与回报设置清单:

- 确定明确的技术触发点(趋势或价格水平)。

- 根据止损距离计算仓位规模。

- 预设部分获利区间。

- 随着结构变化跟踪止损。

据 Deriv 分析师称,2026 年,CFD 的灵活性让交易者能够适应日内波动,同时保持结构化的风险控制。

“不是要预测每一次波动,而是要定义风险边界。”

数字期权(Deriv Trader、SmartTrader、Deriv Bot)

你可以选择方向型或基于价格水平的合约,预设合约期限和投入金额。Rise/Fall 反映短线方向;Higher/Lower 和 Touch/No Touch 聚焦于价格水平结果。

优势:

- 最大亏损固定。

- 简单的方向型和价格水平表达。

- 适用于波动或事件驱动时期。

| CFD | 期权 | |

|---|---|---|

| 交易控制 | 持续管理 | 设定后等待 |

| 持仓期限灵活性 | 开放式 | 预设 |

| 风险结构 | 通过止损定义 | 最大亏损固定 |

补充说明:Deriv 的数字期权非常适合结构化学习。新手可以从 Rise/Fall 入手,理解方向性行为,然后进阶到 Higher/Lower,学习基于价格水平的预测。随着信心提升,可以尝试 Touch/No Touch 合约,检验对波动性的精准预测能力。

哪款 Deriv 平台适合你的交易风格?

| 问题 | Rise/Fall | Higher/Lower | Touch/No Touch | CFD |

|---|---|---|---|---|

| 价格很快会上涨/下跌吗? | ✓ | |||

| 收盘价会高于/低于关键水平吗? | ✓ | |||

| 价格会触及或避开某一水平吗? | ✓ | |||

| 你想要长期管理持仓吗? | ✓ |

CFD 与期权:哪种更适合你的策略?

原油(US Oil / UK Brent Oil)

- 期权:交易者常用 Rise/Fall 把握 OPEC+ 头条或库存报告等事件前后的方向性波动,Touch/No Touch 用于“触及或避开”场景。典型持仓时间:日内 10–30 分钟,或最长 2 小时。

- CFD:常见策略为突破或回调。两者都可将止损设置在真正的无效点之外;在 1R 处部分获利,剩余头寸跟踪止盈。专业交易者主要在伦敦-纽约重叠时段交易,以获取更强流动性。

黄金(XAUUSD)

- 期权:大多数交易者在短线动能爆发时用 Rise/Fall,或在交易时段结束前用 Higher/Lower 测试关键水平。常在事件周(如央行公告)优先选择,因可明确最大风险。

- CFD:专业交易者在上升趋势或区间边缘用微型仓位做结构化回调。部分平仓,跟踪盈利,并在Deriv GO 上设置警报以保持纪律。

实用框架:CFD 适合希望主动控制和分批退出的交易者,期权则适合偏好明确定义风险和时间框定结果的交易者。在趋势行情中,CFD 提供灵活性;在事件驱动市场中,期权可限制风险敞口。

IMF 市场报告提到:

“黄金仍对利率预期和货币趋势敏感。通过期权交易定义风险,使个人交易者无需杠杆即可参与宏观主题。”

天然气

- 期权:交易者常在区间震荡或短暂动能阶段用 Touch/No Touch,尤其在波动性高时。由于该资产价格波动剧烈且不可预测,投入金额通常较小。

- CFD:通常仅在市场结构清晰且波动趋于稳定时交易。交易者常将止损设置得比当前区间更宽,并缩小仓位以应对突发波动。

软商品(如可可)

- 期权:大多数交易者在供应驱动的波动期(如天气扰动或产量新闻)围绕明确水平用小额 Rise/Fall 合约。

- CFD:通常在市场较为平静、价格区间波动时使用。交易者常采用均值回归策略,日内管理持仓,并避免隔夜持仓以规避掉期成本和突发新闻风险。

在不同市场对比 CFD 与期权

| 市场类型 | 最佳工具 | 主要优势 |

|---|---|---|

| 趋势型(原油、黄金) | CFD | 灵活退出与交易管理 |

| 事件驱动(数据发布) | 期权 | 明确定义亏损与时间敞口 |

| 区间震荡(软商品、天然气) | 期权 | 结构简单、投入较小 |

进一步来看,经验丰富的交易者常将两种工具结合。例如,交易者可能会为长期趋势开设 CFD 仓位,同时在波动事件期间用 No Touch 期权作为保险。这种混合方式既能保持风险平衡,又能参与更广泛的市场走势。

为什么 Deriv 平台对未来大宗商品市场很重要?

| 平台 | 最适合 | 主要优势 |

|---|---|---|

| Deriv MT5 / Deriv cTrader | CFD 管理 | 完全控制、部分平仓、跟踪止盈 |

| Deriv Trader / SmartTrader | 时间框定策略 | 每单明确定义风险 |

| Deriv Bot | 自动化 | 基于规则的筛选、冷却期 |

| Deriv GO | 移动端执行 | 警报与基于计划的操作 |

Deriv 的生态系统为适应性而生。交易者可在 Deriv MT5 上分析市场,在 Deriv Bot 上自动化部分策略,并用 Deriv GO 监控进展。这一互联结构确保无论市场状况或设备如何,交易者都能保持掌控。

未来影响大宗商品市场的因素有哪些?

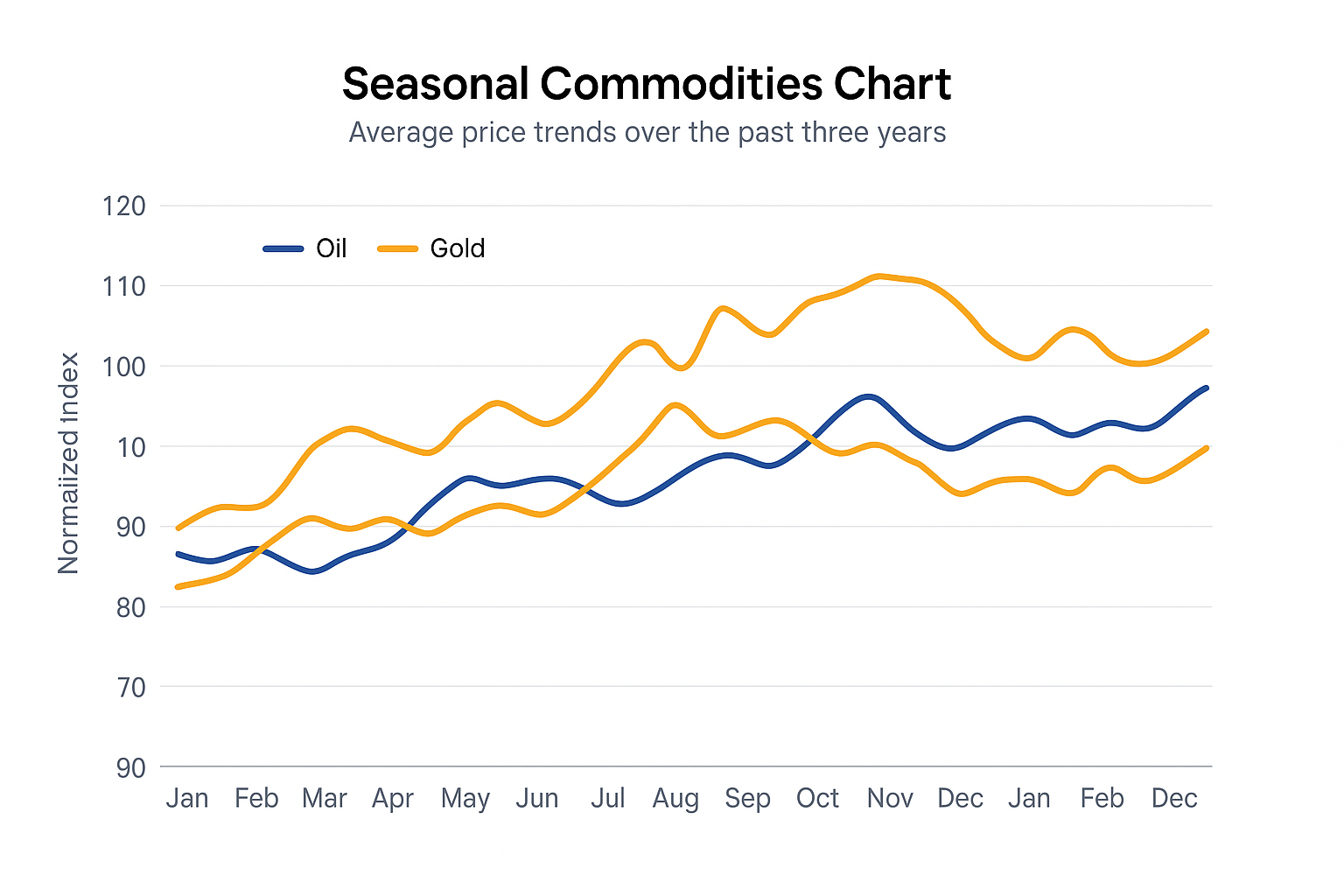

供需:美国能源信息署(EIA)报告常引发原油波动。库存大幅下降通常推高价格,库存增加则带来压力。

天气与地缘政治:OPEC+ 政策、战争和运输中断影响能源和农产品市场。在此类事件中,市场波动性往往加剧,许多交易者会重新评估风险敞口,更倾向于选择明确定义风险的工具。

宏观与货币:黄金对利率变动和美元走势敏感。随着全球利率周期变化,交易者倾向于用期权在宏观不确定时期获得明确定义的风险敞口。

新兴趋势:可再生能源发展和亚洲工业需求正在影响大宗商品价格,尤其是金属。Deriv 上的交易者可用 CFD 把握长期趋势,用期权隔离事件风险。

Deriv 风险策略师解释:

“在 CFD 与期权之间分散投资,是应对波动性的平衡方式。在宏观不确定时期,交易者可保持活跃,而无需承担过度方向性风险。”

季节性:天然气需求在冬季高峰,农产品价格受作物周期影响。专业交易者将季节性视为背景,而非信号。

未来展望:随着数据分析和 AI 交易工具的深度集成,Deriv 致力于在平台内提升模式识别和情绪追踪能力,为交易者提供更清晰的宏观洞察和精准执行。

你需要了解哪些交易风险与策略?

- 波动性激增与跳空:重大事件期间,期权因明确定义风险而常被讨论,而CFD则常与结构明朗后的趋势行情相关联。

- CFD 杠杆风险:CFD 结果与仓位规模和止损距离密切相关,因此杠杆常与仓位管理纪律和明确定义的无效点一起讨论。

- 持仓成本:CFD 持仓过夜可能产生掉期费用,因此在评估长期敞口时,持仓时间和合约规格常被重点审查。

- 滑点:在快市中,实际成交价可能与预期不同,因此挂单和小仓位常被建议;而期权的合约成本在下单前已知,尽管结果仍取决于市场波动。

- 相关性风险:大宗商品市场可能因共同驱动因素而联动,因此相关敞口(如US Oil 和 UK Brent Oil)常被视为投资组合层面的集中风险。

- 模型风险:自动化策略在市场环境变化时可能失效,因此更简单的规则集、更少的筛选条件和更清晰的约束被认为更易于监控和维护。

- 心理风险:过度交易或追损等行为错误广泛存在;期权采用一致的投入金额,CFD 采用预先计划的管理规则,常用于减轻决策压力。

- 操作失误:合约选择(如期限、障碍设置或订单类型)会影响结果,因此在执行计划中强调合约参数与交易思路的匹配。

下单前检查清单:

- 确认新闻和事件日历。

- 核查仓位规模与账户权益比例。

- 下单前设定止损和目标。

- 限制资产间的相关敞口。

- 检查情绪状态,避免冲动交易。

将风险管理扩展到账户整体,交易者常关注账户总敞口及工具间相关性对整体回撤的影响。保证金使用和每日亏损限额常作为更广泛风险管理的一部分进行复查。持续审查保证金使用和每日亏损阈值,是专业风险纪律的基础。

新手如何负责任地参与大宗商品交易?

- 新手可先只练习一种金属(黄金)和一种能源(原油)。

- CFD 每笔风险:账户权益的 1–2%;期权投入 0.5–1%。

- 避免叠加相关敞口。

- 每周进行 30 分钟复盘。

Deriv 大宗商品交易的未来展望

Deriv 持续优化交易技术,推出更多自动化工具、预测性洞察和更优的移动端性能。随着全球市场演变,交易者可期待风险控制工具、AI 分析和平台升级的无缝集成,支持更快执行和情境警报。

此外,Deriv 计划扩展教育支持,通过 Deriv Academy 提供互动学习模块和案例教学,帮助交易者理解宏观经济驱动因素、风险机制和多品种实战交易结构。

要点总结

大宗商品让交易者表达对全球供需和宏观变化的观点。在 Deriv 上,CFD 提供灵活管理,数字期权则精确定义风险。建议从模拟账户开始,保持小额投入,并专注于持续优化一种方法。

免责声明:

大宗商品的数字期权交易不对居住在欧盟的客户开放。

Deriv X、Deriv Bot 和 SmartTrader 平台不对居住在欧盟的客户开放。