EUR/USD forecast: Can the pair rally after the Eurozone’s rebound?

Eurozone business activity surged to a 17-month high in October, led by Germany’s strongest private-sector expansion in over two years, while inflation stayed near the European Central Bank’s 2% target. With the ECB pausing rate cuts and the Federal Reserve preparing to ease, traders see scope for EUR/USD to climb toward 1.20 in the short term.

However, the rally faces limits: France’s weakness, sliding business confidence, and uneven growth across the bloc suggest the recovery may not last long enough to sustain a breakout.

Key takeaways

- The Hamburg Commercial Bank (HCOB) Flash Eurozone Composite, Purchasing Manager’s Index (PMI) rose to 52.2 in October, its 10th straight month of expansion and the highest since mid-2024, defying expectations of a slowdown.

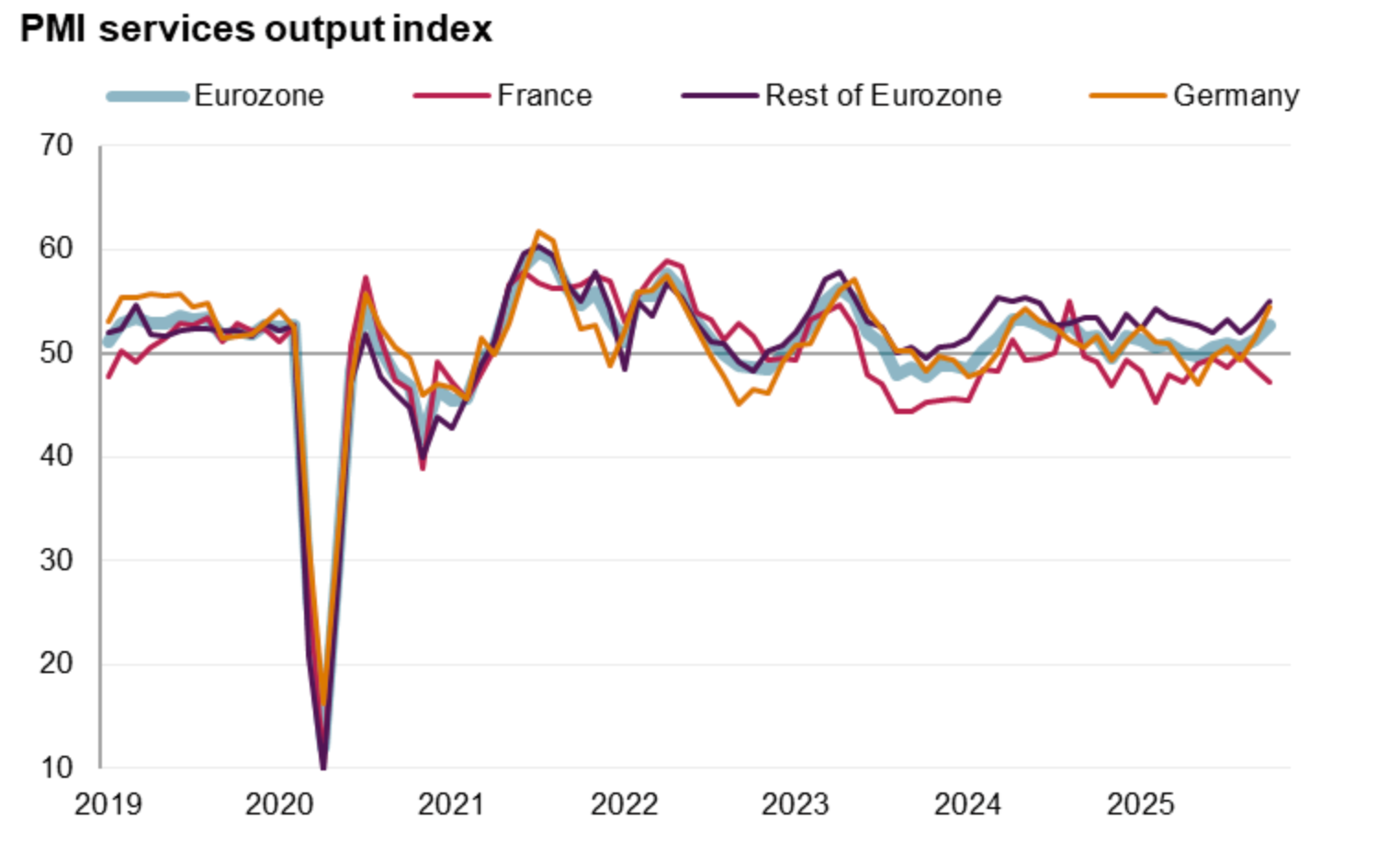

- Germany’s services-led rebound powered the region’s growth, while France contracted faster than forecast, creating a two-speed recovery.

- Inflation pressures remain moderate, with services prices rising slightly but staying near the ECB’s long-term average.

- The ECB is expected to hold rates, contrasting with the Fed’s upcoming 25 bps cut, which could weaken the dollar.

- Despite strong data, business confidence fell to a five-month low, hinting that firms remain cautious about future demand.

- EUR/USD trades near 1.1650, supported by monetary divergence but capped by fragile sentiment and uneven growth.

Eurozone PMI data: Economic activity hits a 17-month high

The Eurozone economy accelerated unexpectedly at the start of Q4. The HCOB Flash Eurozone Composite PMI, compiled by S&P Global, climbed to 52.2 in October from 51.2 in September, far above the consensus estimate of 51.0. Readings above 50 indicate growth, marking the tenth consecutive month of expansion.

New orders grew at their fastest pace in 2½ years, suggesting renewed business momentum.

"October’s flash PMIs suggest the euro-zone economy may have gained momentum at the start of the quarter."

- Adrian Prettejohn, Capital Economics

Germany was the standout performer. Its private sector recorded its strongest growth since early 2023, driven by a robust rise in services activity. This boosted the euro in currency markets and revived optimism that Europe’s largest economy could anchor a broader recovery.

France, however, painted a different picture. Its PMI fell deeper into contraction as demand for goods and services weakened amid political tensions and fiscal uncertainty.

For traders analysing these developments on Deriv MT5, the PMI figures serve as a clear indicator of economic momentum likely to influence the EUR/USD trend through Q4.

ECB interest rate decision: Holding the line as inflation steadies

Inflation in the services sector remains moderate, with price increases near the ECB’s long-term average. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said the data “confirms the ECB’s stance not to implement further interest rate cuts.”

The central bank is widely seen as ending its easing cycle, with inflation hovering around 2%. In contrast, the U.S. Federal Reserve is expected to cut rates by 25 bps this week, following a softer-than-expected September CPI of 3.% year-on-year. Core CPI slowed to 3.1% from 2.9% in August, reinforcing bets on a dovish shift.

This policy divergence - ECB steady, Fed easing - creates favourable conditions for the euro, especially as the U.S. Dollar Index (DXY) trades near 99.00, its lowest in months.

Confidence falls despite the rebound

While headline data impressed, underlying sentiment weakened.

- Business confidence slipped to a five-month low, showing that firms remain cautious about demand.

- Employment rose again in October, with services hiring at the fastest pace since June 2024.

- Manufacturing employment, however, fell at the quickest pace in four months, underscoring uneven demand across sectors.

Operating costs increased at a slower pace, yet selling prices ticked higher, suggesting mild inflationary pressure but no signs of overheating. This dynamic - rising activity, but subdued confidence - suggests the current rebound could lose momentum if new-order growth cools.

U.S. factors: Fed cuts and dollar weakness

The U.S. Dollar Index (DXY) slipped below 99.00 after the soft CPI print, reflecting investor expectations for a 25-basis-point Fed rate cut. The Fed’s easing bias contrasts sharply with the ECB’s pause, reducing yield spreads in favour of the euro.

Geopolitical developments add another tailwind:

- U.S.–China trade talks in Kuala Lumpur have eased tariff concerns, with Washington dropping threats of 100% import duties.

- China’s delay of its rare-earth export restrictions and expected purchases of U.S. soybeans have improved global risk sentiment.

These factors have helped push EUR/USD higher for four consecutive sessions, now trading near 1.1630.

EUR/USD market outlook: 1.20 or fade?

Bullish case:

- Strong German services growth and 17-month-high PMIs signal a broader recovery.

- ECB’s rate stability supports euro yields versus a softening dollar.

- U.S. disinflation and dovish Fed policy narrow the transatlantic rate gap.

- Positive sentiment from trade diplomacy may lift risk assets, supporting the euro.

Bearish case:

- France’s weakness and Europe’s political instability could undermine confidence.

- A fragile manufacturing sector and slower new orders may limit follow-through.

- If U.S. data rebounds or the Fed signals caution on further cuts, dollar strength could return.

Most analysts see EUR/USD supported above 1.16, with 1.18–1.20 as near-term resistance. Sustained momentum above 1.20 will likely require a continuation of German outperformance and further confirmation that Eurozone growth is broad-based.

EUR/USD technical analysis

EUR/USD remains range-bound between 1.1870 resistance and 1.1566 support, with price hovering near the mid-Bollinger band and the RSI flat around 58, signalling neutral momentum.

The narrowing Bollinger Bands indicate fading volatility and the potential for a breakout. A move above 1.1728 could invite renewed buying toward 1.1870, while a drop below 1.1566 may trigger further selling. Until then, the pair is likely to trade sideways, with traders watching for an RSI breakout or band expansion as the next directional cue.

EUR/USD investment implications

For traders and investors, the balance of risk in EUR/USD tilts upward in the short term but remains fragile.

- Short-term strategies: Buying dips near 1.1600 may offer upside toward 1.1850–1.20 if Fed dovishness persists and Eurozone data confirms sustained momentum.

- Medium-term positioning: Caution is warranted; if business sentiment fails to recover or German strength fades, EUR/USD could retreat toward 1.1550.

- Macro context: The ECB’s steady policy and Germany’s rebound contrast with the Fed’s softening stance - creating a favourable environment for euro resilience into Q4.

- Political watchpoints: France’s budget tensions and any disruption in U.S.–China trade progress could quickly dampen euro optimism.

Using Deriv’s trading calculator before entering positions helps estimate margin and pip values, a crucial step when managing risk around volatile currency pairs like EUR/USD.

The performance figures quoted are not a guarantee of future performance.